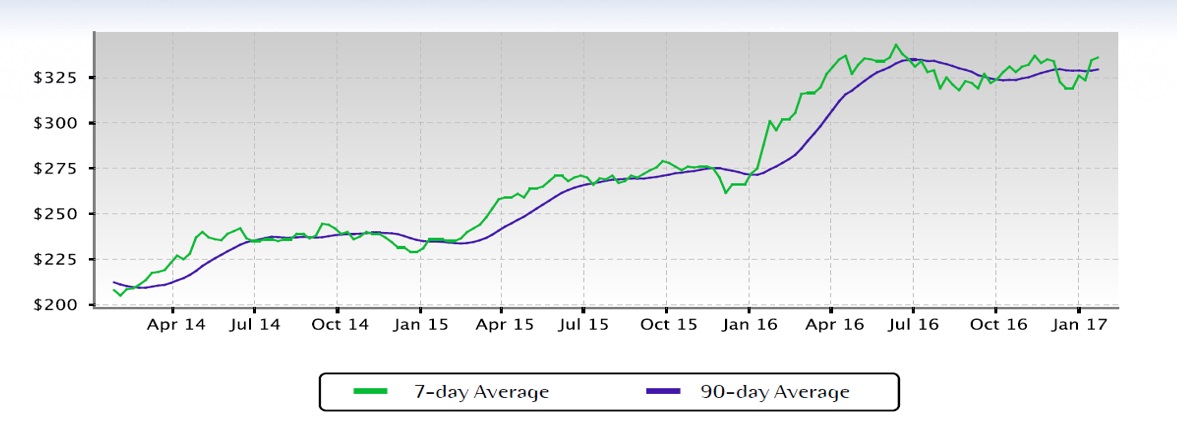

Price per Square Foot.

If you have been a consumer in the Seattle Real Estate Market over the past several years, you may have noticed some changes. Does it seem like there are fewer homes available? Do you think that home prices have increased? But, really you aren’t exactly sure what’s going on in the market?

This blog will explain the Seattle Real Estate Market by reviewing some historical information. To make things simple, let’s delve into two major components of what impacts the Real Estate Market: Price per Square Foot and the Inventory of Homes for Sale.

Let’s start with Price Per Square Foot from April 2014 through January 2017.

In April 2014, the average price per square foot was $215. In January 2017, the price per square foot was $326, which is an $111 per square foot difference.

To put it into context, let’s say you found a single family home that you wanted to purchase. The home is 2500 square feet. If you bought that home in 2014, the home would cost $537,000 ($215 price per square foot x 2500 square feet). If you bought that same home today in 2017, the home would cost $815,000 ($326 price per square foot x 2500 square foot).

That’s a $278,000 difference from 2014 to 2017. This basic equation shows a very shocking, if not mind-blowing difference in what has happened to the real estate market in Seattle over the past 2.5 years.

Although this chart shows an overall uptick in price per square foot over the course of the past several years, there is something very important to absorb from this data. Pay attention to the rise and falls of the pricing each month. You will notice that historically, the least expensive price per square foot is in the winter months, whereas the pricing peaks in the summer months. Each and every year – prices rise in the spring and summer, and they lower in the fall and winter. You begin to see that Seattle’s Real Estate Market is actually both a seasonal and a cyclical housing market.

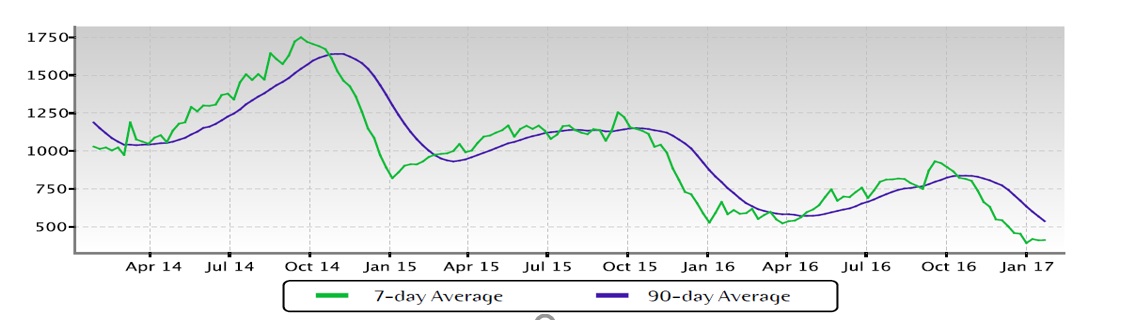

Now, let’s address the available number of homes on the market from April 2014 to Janaury 2017.

Inventory of Homes for Sale.

In April 2014, there were 1200 homes on the market to sell. Today, there are 500 homes on the market to sell. That means there are 700 less homes on the market today than there were two and a half years ago.

Beyond the fact that there are fewer homes available on the market, this chart also reveals more to the consumer. You will notice that historically, from approximately March to October you will see the most available homes on the market. In the colder, winter months there is a general decrease in homes available. Again, you see a trend here. Year over year, you begin to see that Seattle’s Real Estate Market is both a seasonal and a cyclical housing market.

So, putting the data together, you have a classic case of supply and demand. There were more houses on the market 2 years ago, and they cost less then. Now, there are fewer homes on the market, and the price has increased. Having fewer homes on the market means that the same buyers are vying for the same houses. In many instances, many offers are put in on the same home by several buyers, which creates a multiple-bid scenario where buyers are willing to pay more. Buyers escalate the price of their offers to get the winning bid for the home.

But, the biggest take-away here is that this historical data has demonstrated that the Seattle Real Estate Market that the market is cyclical, and therefore more predictable.

Of course, there is no magical looking glass. This data is not an all-encompassing method for how to price a home if you are a seller or how much you should put in an offer for if you are a buyer. But understanding Seattle’s Real Estate Market, provides a huge advantage in the market place. Coupled with this knowledge, our experienced Real Estate Brokers at RE/MAX Pacific Realty will be able to provide you with a multi-faceted strategies and solution-based results.

Source: Altos Research